Introduction

The world is under the attack of Coronavirus. There is lockdown throughout the world and it is impacting all walks of life and people have started buying only necessities. The coronavirus causes uncertainty. Billions of people around the globe are under quarantine. Nevertheless, new reports of contagion are constantly coming in from various regions. The uncertainty of the markets is correspondingly great. Last but not least, the uncertainties surrounding investors include the question of the economic consequences. The banks’ analysis departments try to quench their thirst for knowledge. They are rapidly producing all sorts of studies on the consequential costs of the virus, although it is difficult to isolate the impact of individual factors on the economy. This report will tend to review the impact of COVID-19 on the global economy. For this purpose, first of all, secondary literature about the impact of previous pandemics and any new literature about the current pandemic will be analyzed. Then the impact of the current pandemic will be analyzed on the businesses globally.Literature Review There is not much literature currently available on the impacts of Coronavirus. However, studies on the impacts of previous pandemics are widely available. The calculations should, therefore, be treated with a certain reluctance. According to the workshop on The Influence of Global Environmental Change on Infectious Disease Dynamics (2014), fortunately, serious infectious diseases are rare, so that there is little experience with which to feed the forecasting models. Second, the past is not always an indicator of the future. It is therefore somewhat delicate to assume that two researchers from Harvard University believe that due to the three pandemics registered in the 20th century, the likelihood of a pandemic is 3% per year even today. Such a sentence of three ignores the medical, economic and social upheavals of many decades.

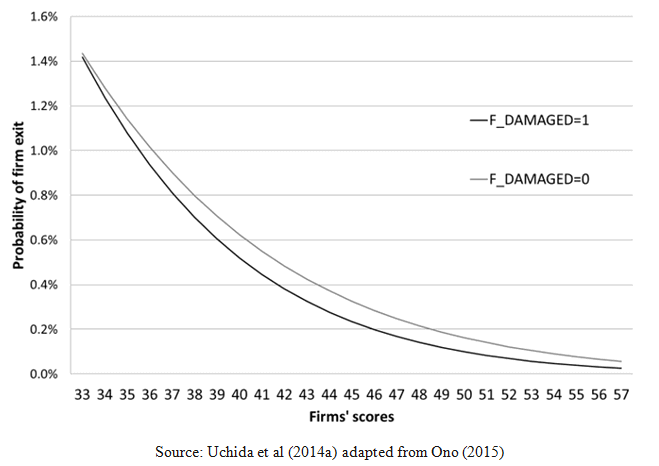

But how can an economist approach the coronavirus? The experts are similarly viewing the crisis to natural disasters, such as storms. According to Ono. (2015), “For firms, natural disasters destroy tangible assets such as buildings and equipment – as well as human capital – and thereby deteriorate their production capacity. These adverse impacts may sometimes be fatal to the firms and result in them being forced to close down”. These also shock the economy concerned. “In some cases, employees cannot go to their workplaces, which is why production is falling.” The sudden shock is currently evident in the number of passengers on the Chinese railways, which have plummeted after the spread of the virus. However, he is also of the view that disasters can bring creative destruction afterward.

Economically, epidemics and pandemics – the latter are known when the pathogen spreads across different countries and continents – can be viewed from two perspectives: On the one hand, such events influence the supply of work, for example, because workers stay at home, fall ill or even die in extreme cases. If less work is done, the economic output drops. On the other hand, it can be observed from a demand perspective that consumers hardly spend any more money. They are scared, stay at home, avoid restaurants, markets, cinemas, and other public places. Only the bare minimum is bought, which affects the economy and above all the manufacturers of luxury goods. (Bloom et al., 2018)

Past epidemics or pandemics have shown that the indirect effect on-demand tends to outweigh the direct effect on the supply side. This was shown, for example, by the Sars pandemic that also broke out in China at the end of 2002. What was most troublesome for the economy in China and elsewhere at the time was not the shutdown of some factories or the disruption of value chains. The precautionary measures taken by the population were serious – but understandable from an individual point of view. People gave up traveling, canceled vacations and were no longer in a shopping mood.” Concern over the spread of even a relatively contained outbreak can lead to decreased trade. For example, a ban imposed by the European Union on exports of British beef lasted 10 years following the identification of a mad cow disease outbreak in the United Kingdom, despite relatively low transmission to humans.” (Bloom et al., 2018)

The peculiarity of epidemics or pandemics is known from the experience with Sars. The uncertainty surrounding the infection at the time quickly led to a sharp decline in retail sales, tourist numbers, stock exchange prices, and growth. However, as the economic outlook seemed uncertain in those days of uncertainty, the economy recovered quickly from the shock. This means that the effects of the pandemic were violent, but only for a short time. After only a few months, hardly anything in the economic data reminded of Sars. (Maggiulli, 2020)

Some data on the V-shaped course of follow-up costs underline this: The growth of China’s gross domestic product (GDP) plummeted in the second quarter of 2003, when the Sars crisis had peaked, from an estimated 12% in the previous quarter to 3.5%. The decline was mainly due to the collapse of tourism and related sectors such as transportation. The growth in the retail trade also fell sharply compared to the previous year, from 9.2% to 6.8% in the second quarter. International air traffic in the Asia-Pacific region was even more than a third below the pre-crisis level in May 2003, measured in terms of passenger-kilometers. (“How big a dent in the economy?”, 2003)

However, the sharp decline in these economic sizes was followed by rapid recovery, also thanks to fiscal policy tailwind from Beijing. Already in the fourth quarter of 2003, GDP growth was close to the pre-crisis level. And the expansion of the retail trade, the hotel industry, and air traffic already exceeded the plus before the outbreak of the crisis. A similar picture emerged on the stock exchange. There, the MSCI index for China compensated for the price losses after only six months. The recovery on western stock exchanges was even faster. Those who had used the price drops for purchases were rewarded amply. (“How big a dent in the economy?”, 2003)

The most common assumption is that global economic output (measured by GDP) will decrease by 0.6% or USD 500 billion. At the same time, the consensus expects the V-shaped recovery of the economy within 3 to 12 months. (Elliott, 2020)

Regionally, however, significant differences can be expected, especially concerning the effects on the economic development of first world countries and developing countries.

The most negative estimate of a study for an assumed Ebola outbreak in Sierra Leone predicts a 16% drop in gross domestic product for this country. (Elliott, 2020)

The reasons for this are the poor medical care in comparison to industrialized countries, the generally poorer health care situation of the population, as well as the high population density paired with poor hygiene (keyword: access to clean drinking water).

In a model calculation from 2013, the World Bank assumes that the likelihood of a global pandemic occurring is very low at 1% to 3%, but that with a high infection rate (similar to the Spanish flu), the costs for the global economy are up to three Could be trillions of dollars. (Jonas, 2013)

Nevertheless, there are some analogies between the Sars crisis and the current situation. China’s global networking with western countries has increased significantly since 2003. There are significantly more cross-border supply chains. The rapidly growing tourism sector in China, whose share of GDP has increased from 2% to around 5% since 2003, is also associated with a higher level of vulnerability. The country has also gained in global economic weight: since the outbreak of the Sars crisis, China’s share of global output has quadrupled. Therefore, if China’s growth stutters today, it is of far greater importance for the global economy than in 2003. (“How big a dent in the economy?”, 2003)

The Covid-19 is pretty much like the Flue viruses that create hovacs in the past. An epidemics or a pandemic is such incident or activity that impact several countries negatively (Jonas 2013). He is further of the viw that “the most severe of the four flu pandemics in the last 100 years, the 1918 pandemic, killed 50 million-100 million people in a global population of less than 2 billion.” He is of the view that if a severe case like that in 2013 occurs, the economic losses could be anything around 4.8 percent of world GDP, or it can exceed $3 trillion. A moderate flu pandemic, just like one we are experiencing now, COVID, 19 may result in half of that impact.

After all, Beijing’s regime has learned from the Sars crisis. It reacted faster and more consistently to the coronavirus than it did then. China’s health system is also in better shape today than it was 17 years ago. For Beijing, however, more is at stake as the structure of the economy has changed. The trend is moving away from industry and investment towards services and consumption. The service sector is already responsible for 52% of GDP. This rebalancing is politically wanted; however, it means that those sectors that are particularly likely to suffer from the coronavirus make up a larger part of the economy than recently. (“How big a dent in the economy?”, 2003)

Data Source and Description of Data

Corona is a new pandemic. Moreover, the world is under lockdown currently. There is not much research on the pandemic for now as it can be at the ending time of the pandemic because the impact of the pandemic is pretty much unknown for now. However, for this assignment, secondary data will be used. It is the data that is collected for another purpose. Mainly qualitative data will be used to assess the impact of the pandemic as already analyzed under the literature review. Moreover, qualitative data will also be used to assess the impact of a pandemic on the global economy and different businesses.

The main data source is the recent study by KPMG on the economic impact of COVID-19. According to the report, the risk of global recession is very high as the countries are locking down and shutting down economic activities to limit the spread of the Novel Coronavirus. As the production is limited around so many companies will not have the necessary inputs to produce products or services. The manufacturing in China is down by 20% until February as compared to January. The market needs easy and cheaper debt to functions in this situation because ofa lack of productivity and unavoidable fixed costs. But it is a double edge sword because higher the debt levels, the costlier and economically damaging will be the social distancing. This is why firms and individuals need cheap debt.

Nations are required to lower the peak of the pandemic to avoid overwhelming health systems. This is because it spreads very rapidly and 20% of those who contact it would need hospital treatment.

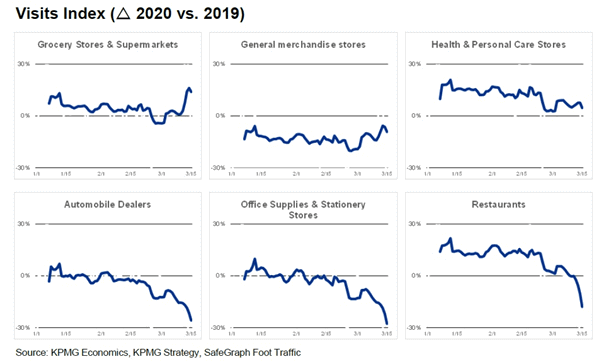

The report further says that there is an inverse relationship between the health and the economic impact. Social distancing is leading to the collapse of economic activities. It is expected to decline by 100%. The restaurant is a proxy for retail activities. The restaurants and retails businesses are already operating at thin margins and may start laying off employees. Already the unemployment claims are very high in the USA. The situation is pretty much the same in other countries.

This is because, as revealed in the above graphs, the retail businesses are suffering. After all, activity is significantly decreased.

Another major reason for the decline of the economy is that China is the major trade partner of most countries and the decline in production activity in China is also impacting other businesses around. Around 25% of Baa bonds are under threat of getting downgrading. The dollar is getting strong and because of the decline of other economies around the world which is further hurting the dollar borrowers globally. On the other hand, oil prices are also significantly declined which hurt several oil depending countries as well as hurting several companies that depend on oil. The situation is even worst in China where all sectors are suffering greatly.

Analysis and Discussion

Because of this extent, the World Bank warns that the international community has under-implemented preventive measures. It is estimated that the impact of this pandemic could be around three trillion to the global economy in the extreme case.

In general, the economic costs are greatest in all sectors in which customer contact takes place face to face and in which consumption cannot be put off.This affects numerous areas of the service sector, especially tourism and the leisure industry. Companies with complex and globalized supply chains that are disrupted by measures to combat a pandemic are also affected above average.

Cost of an epidemic/pandemic

At the country level, those economies that are more dependent on the labor force are disproportionately affected.

Thus, the cost of an epidemic or pandemic is more significant in developing countries than in developed countries, whose economies have a higher degree of automation and digitalization.

The degree of networking between regions is also an important factor influencing the spread of infectious disease and the level of costs. For example, viral diseases spread much faster in open economies such as Europe than, for example, in the Middle East, where the individual countries are more isolated from each other.Human behavior is an important element in the costs of pandemics. The fear of infection can complicate containment as well as have immediate negative economic effects.

The sociology of quarantine

This begins with the sociology of quarantine, from which people try to escape to avoid possible contagion and thereby carry the virus on even more.However, it can also be read from the literature that many people virtually flee into self-quarantines to avoid being infected. This self-quarantine begins when you do not visit places where there is an increased risk of infection (events, restaurants, cinemas, travel, etc.), which harms consumption.

As past pandemics have shown, numerous people stay away from work in particularly affected areas so as not to become infected.Studies have shown that such self-imposed protective measures can account for around 60% of the follow-up costs of a pandemic.In return, only about 28% of the total costs resulting from the sick leave of employees.

Transport & globalization: framework conditions have changed adversely

The most noticeable is the strong increase in traffic worldwide over the past decades. This applies to the transportation of goods as well as the increased travel activity of people. Added to this is the globalization of the supply chains, which have also become significantly more important in the recent past.All of this has increased the vulnerability of the global economy. After all, the economic environment can be assessed as more challenging than in the past pandemic.

Current economic growth is in a phase of cooling off after several years of a strong upswing. At the same time, China’s and Southeast Asia’s share of global economic output has increased significantly over the past 10 years.

A pandemic can have a major impact on the global economy today

A pandemic, especially one that started in China, could, therefore, have a greater impact on the global economy in this environment than past epidemics.Also, the central banks havelittle scope in the ongoing low-interest rate landscape to effectively counteract possible negative effects.

A study from 2006, for example, recommends the European Central Bank to cut key interest rates by 100bp as the first countermeasure. Such a step would not be possible today.Another important point is social media, which has been established in our societies over the past 10 years. These media can become panic enhancers, further increasing the cost of a pandemic.

Initial findings on the Corona Virus do not suggest a serious course

Due to the early stage, there is still no conclusive information about the currently rampant Corona Virus, but the previous course allows the first conclusions to be drawn.The transmission rate of the Corona Virus seems to correspond to a cold or an aggressive form of the flu. In this case, an infected person passes the virus on to two to three people. The mortality rate of the COVID-19 virus seems to be slightly higher than that of the common flu virus, but significantly lower than that of the Sars virus.

The course of the number of new cases in China also leads to the conclusion that the pandemic period is likely to be within the scope of what was also observed in other pandemics (Spanish flu, swine flu, common flu, etc.). At the time, the pandemic had peaked at about three months.

Against this background, based on current knowledge and analysis of various studies on this topic, it can be assumed that the global spread of the Corona Virus does have an impact on the global economy, but this effect should not be too serious and should be leveled out in about 12 months.

Furthermore, it has so far been shown that the age cohorts 70+ and 80+ are disproportionately affected by a severe course of the disease, whereas the workable population (especially the age group 20 to 60 years) usually has a mild course of the disease.

How badly can the corona crisis hit the economy?

This is a kind of flue Pandemic and (Jonas 2013). The most severe of the four flu pandemics in the last 100 years, the 1918 pandemic, killed 50 million-100 million people in a global population of less than 2 billion.” He is of the view that if a severe case like that in 2013 occurs, the economic losses could be anything around 4.8 percent of world GDP, or it can exceed $3 trillion. A moderate flu pandemic, just like one we are experiencing now, COVID, 19 may result in half of that impact.

After that, deferred production and demand would pick up again and compensate for shortfalls. In a negative scenario, OECD chief economist Laurence Boone anticipates a 1.5 percent decline in global economic growth. In the worst case, the current crisis could also plunge the global economy into recession.

One of the hardest hit industries is an overview. All package tours and cruises do not take place for the time being due to the requirements of many governments to contain the virus, hotels are being closed. Due to this, the Airline industry is also very severely hit because no one is traveling except those who are stuck somewhere. Almost all industries are down and businesses are suffering greatly(Bain, 2020). The situation of some businesses is analyzed as follows.

Banks and savings banks

The banks are also impacted greatly and more and more banks are opening only branches. Savings banks are also closing branches. But, the banks are still serving customers as they can still withdwar funds from ATMs, online banking and telephone and video advice. The private banks emphasized that the cash supply was secured. This means that consumers are able to withdraw cash from several of the supermarket checkout points. The supermarkets are currently in circulation and theirpeople can get supplies.(Bain, 2020)

Fashion and sports retail

The Swedish fashion chain H&M closes its shops in several countries. While the hard corporate restructuring is in full swing, all activities concerning costs and risks are now being put to the test to mitigate the negative effects associated with the virus as far as possible, announced H&M. The Swedes are the world’s second-largest fashion retailer behind the Spanish Inditex chain, to which Zara belongs. The sporting goods manufacturers Nike, Lululemon Athletica and Under Armor announced store closings in the United States, Europe, and other countries over the weekend. The fashion chain GAP reduces opening hours in the USA and Canada and closes over 100 branches. Urban Outfitters with the Anthropologie and Free People brands announced that stores worldwide are up to at least 28. (Bain, 2020)

Restaurant Industry

The restaurant industry is impacted greatly due to lock down and social distancing. Hotels, restaurants, and caterers are increasingly suffering from the consequences of the coronavirus spread. This is because people are not going out for dining and due to fear of the virus, people are not ordering home delivery as well. (Hunter, Kim, and Rubin 2020).

Cars and Other Vehicle Construction Industry.

Vehicle sales are all time down. This is because people are afraid of their lives. Then jobs are also being lost. Travelling is almost ended so people are not buying cars. Then the companies are also not buying busses and trucks. All the important conferences are now only held online. No more delegations are received, almost all business trips are canceled and put on hold.Many manufacturers said that they simply put their annual press conferences online. BMW, for example, does it this week. The Volkswagen Group, led by CEO Herbert Diess, will also switch to the phone to discuss the most important annual figures. The individual brands of the VW Group completely canceled their annual press talks. It is currently not possible to discuss a market outlook for 2020 and beyond, according to the VW brand. Audi is also likely to forego its conference call. More and more car factories in Europe have to close. VW shuts down Seat’s production at Martorell in Spain and the VW plant in Navarra. The VW plant near Lisbon cuts production by 16 percent. The reason is a shortage of workers after the Portuguese government ordered all schools to be closed. A VW spokesman said that supplying the plants with parts would become increasingly difficult due to the border closure in Europe. Production in the USA was also affected. Fiat-Chrysler announced that it would not work in the Italian factories until March 27. Production in Kragujevac, Serbia, and the Tychy Plant in Poland would be closed. The suspension enables the carmaker to react to the lower demand for cars. Ferrari and Lamborghini are also pausing. The French companies Renault and PSA, to which Opel belongs, are suspending production in Europe. In Germany, the Rüsselsheim and Eisenach sites are affected. First slumps in exports to China and Italy, Now the disappearing domestic catering business: Many of the 1,500 German breweries are facing major problems from the coronavirus pandemic. Even if the official measures are taken are understandable and justified, the economic situation for the catering trade and with it, the breweries are getting worse every day. The cancellation of thousands of events is bad, the impact on the beverage industry is dramatic (Coronavirus – How the crisis hits companies – Economy 2020).

What differentiates this epidemic crisis from previous economic crisis scenarios?

The corona epidemic is complex. Due to the expansion and production stops initially in China, global supply chains have broken. The world is dealing here with a kind of lightning crisis, in which the economic expectations have suddenly deteriorated. And in this crisis, the previous economic policy measures are not working – or only to a limited extent. Because weeks of production shutdowns – especially in China – parts for the production are missing elsewhere in the world. (Hunter, Kim, and Rubin 2020).

China is the workshop of the world. Finally, quarantine measures such as those in Italy and the cancellation of public events also affect the service sector. The virus should be as contagious economically as it is medically. The epidemic could trigger economically persistent pain and cause deep economic wounds.

Are the economic policy measures announced so far sufficient?

Many economists welcome the fact that governments have reacted quickly and have announced help for the economy. In the US, for example, this is easier access for companies to short-time benefits. However, much more needed to be done in a situation where businesses are suffering from lockdown and social distancing and employees are losing their jobs. (Hunter, Kim, and Rubin 2020).

From an economic point of view, the situation is a “great danger. In such a situation the most important goal for the governments around the globe is to ensure confidence that the health crisis does not become a systemic economic crisis that affects the labor market, banks and financial markets and thus further weakens domestic demand. As a last resort, it is alsosuggested that, if necessary, the state should provide cheaper loans to the businesses. Governments around the globe are working on it already.

What role do central banks play?

So far, some central banks have responded. The American FED cut its interest rates by half a percent, the Australian central bank also reacted with interest rate cuts and the British central bank followed suit on Wednesday. With this, the central banks want to ensure that banks and companies continue to get money and loans even in times of crisis. (Hunter, Kim, and Rubin 2020).

However, many observers consider the effect of such measures to be rather limited because it does not help companies that simply cannot produce due to the epidemic. After a slump in the stock market, it is not likely that the market recovers soon because the business that drives the value of the stocks is closed. Only a very few sectors like health care are working.

Because business prospects in many areas of the economy have deteriorated significantly due to Corona, the uncertainty on stock exchanges and financial markets will remain similar in the near future.

So far, however, economists have hopes that the second half of the year could pick up again when the first severe wave of epidemic and countermeasures is over and the economy gradually finds its way back to “normal” paths. Uncertainty in the financial markets is likely to remain high inthe near future.

Conclusion

Pandemic risk is the expected value of the impact of widespread infectious disease in humans on human health. Pandemics are epidemics (occurrence of disease above an expected norm) that affect at least several countries on more than one continent. A salient characteristic of this risk is that it combines a low probability of occurring with high, potentially catastrophic, global impact. Novel Corona Virus initiated from China and is not hurting the whole world. Businesses globally are suffering because of the pandemic. Unemployment is rising as businesses are not able to generate enough money to pay their employees. not only personal life but professional life is also impacted greatly due to this issue. As evident from past pandemics, this pandemic can result in a loss of around 3 trillion in an extreme case. The governments are trying to fight the virus and trying to keep their curve flat through social distancing and lockdown. Every business is suffering and there is no solution to this problem. Governments are required to help companies with cheaper debt so that they can survive in this difficult situation.

References

Forum on Microbial Threats; Board on Global Health; Institute of Medicine. The Influence of Global Environmental Change on Infectious Disease Dynamics: Workshop Summary. Washington (DC): National Academies Press (US); (2014) Sep+6 3. 1, Workshop Overview. Available from: https://www.ncbi.nlm.nih.gov/books/NBK241611/

Ono, A. (2015).How do natural disasters affect the economy? World Economic Forum. Retrieved from: https://www.weforum.org/agenda/2015/02/how-do-natural-disasters-affect-the-economy/

Bloom, D., Cadarette, D., & Sevilla, J. (2018). Epidemics and Economics.FINANCE & DEVELOPMENT, JUNE 2018, VOL. 55, NO. Imf.org. Retrieved 16 April 2020, from https://www.imf.org/external/pubs/ft/fandd/2018/06/economic-risks-and-impacts-of-epidemics/bloom.htm.

Maggiulli, N. (2020). Just How Badly Can the Coronavirus Mess Up the Stock Market? – Traders Magazine. Traders Magazine. Retrieved 16 April 2020, from https://www.tradersmagazine.com/news/just-how-badly-can-the-coronavirus-mess-up-the-stock-market/.

Jonas, O. B. (2013). Background Paper: Pandemic risk. World Development Report. World Bank. Retrieved from: rldbank.org/content/dam/Worldbank/document/HDN/Health/WDR14_bp_Pandemic_Risk_Jonas.pdf

Hunter, C., Kim, K., and Rubin, H. (2020). COVID-19 Economic Impacts. KPMG

Coronavirus – How the crisis hits companies – Economy (2020). Archyde.com. Retrieved from: https://www.archyde.com/coronavirus-how-the-crisis-hits-companies-economy/

Bain, M. (2020). vulnerable to coronavirus than other retailers? Retrieved from: https://qz.com/1812697/are-hm-zara-more-vulnerable-to-coronavirus/

Please place the order on the website to get your own firstly economicsassignmentshelp.com result.

More Samples

Critical Thinking Judgment Visions And The Life OF A Product Manager